“One of the funny things about the stock market is that very time one person sells, another one buys, and both think they are astute.”

— William Feather

No-one knows anything.

This was William Goldman’s main contention in his bestselling autobiography, Adventures In The Screentrade. Goldman knew the movie industry as well as anyone. He wrote a number of screenplays that were made into hugely successful movies, including The Princess Bride[1], Butch Cassidy & The Sundance Kid and All The Presidents Men. And he had his failures too.

No one knows anything.

What he meant was that no-one could ever tell until a movie was finished if it was going to be any good. Brilliant scripts with wonderful actors & directors and good harmony on-set could turn out to be awful movies. While seemingly bad scripts, unknown actors and lots of strife on-set could sometimes turn out to be fabulous movies. His point was that it was impossible to tell beforehand, and nobody had a clue till the movie was finished.

In recent years, Justice League, starring Ben Afleck, Henry Cavill & Jason Mamoa, was expected to be a huge success. But it ended up making just $60m at the box office – a fraction of the movie’s $300m budget!

And think of Cats. No, on second thoughts, don’t…

Insiders knew that Titanic was going to flop when it went so over-budget. But it ended up one of the biggest grossing movies of all time.

I could keep going…

Ask Raven

Goldman’s book made me think of the world of finance… Could it be that investors know nothing?

In 1999, the 22nd most successful money manager out of 6,000 brokers on Wall Street delivered a return of 213%. Her name was Raven and she was a six-year old chimpanzee! She had her own index called MonkeyDex. Seriously. She chose stocks by throwing darts at a list of 133 internet companies.

No doubt you’ve heard the jokes about blindfolded monkeys before. The claim that monkeys could be just as good at choosing stocks as professionals was first made by Princeton University Professor, Burton Malkiel, in 1972.

Sure, you nod along now, but in a few months’ time, when you think about your finances and want to build something for the future, I bet you’ll be seduced into believing once more that finance brokers have a special insight into the future and you’ll doubt that monkeys could be just as good as experts who carefully choose every stock.

I’m pretty sure this is how I’ll crumble.

Turns out, you and me are right to be skeptical that blindfolded monkeys could be just as good as the experts. But not for the reasons we think.

Some years ago, Research Affiliates replicated the effect of monkeys throwing darts. They created 100 portfolios, each of which contained 30 randomly selected stocks from a universe of 1,000 stocks, studying how they would’ve fared over the period 1964–2010, with the 30 stocks being randomly selected each year. They were trying to see how many of the 100 portfolios beat the weighted return of the 1,000 stock universe. How many of the 100 portfolios do you think beat the weighted return? What’s your guess? 10%? 30%? 50%? 50% would make the monkeys just as good as the experts.

The answer is 98%![2] There was more risk in the random portfolios, but still… we’re talking monkeys! Kind of.

But the message is clear…

Investors know nothing.

More Sophisticated Excuses

One of the traits you need to be a supposedly brilliant investor is a better ability to predict the future than other people.

But as Niels Bohr said, “Accurate predictions are notoriously difficult to make. Especially about the future.”

It’s sometimes noted of economists and of other “professional” predictors that their predictions are no more accurate than those of Joe Public. It’s just that they end up being inaccurate “for far more sophisticated reasons”. No one could’ve predicted Covid would happen when it did, they say; or that Russia would invade Ukraine. If it wasn’t for that aberration, the experts claim, their prediction would’ve been right!

Genius!

To continue the theme of financial predictors, imagine a situation where you receive an email at the start of the year from an adviser who claims to have a great understanding of the stock market. He says he expects Apple stock to rise in January. Lo and behold, at the end of January he is shown to be right! Apple stock has risen. He emails to say that it will rise again in February. And lo, he is proven right again! His March 1st email says he expects Apple stock to fall in March; and again he’s proven correct at the end of the month. This pattern continues – accurate monthly predictions of a rise or fall in Apple stock, and so, by September, after 8 correctly predicted months, you sign up to have this financial adviser look after your money. Of course you would, right? This guy is a genius!

But consider the scenario where this financial adviser emailed 64,000 people on 1st January. He emailed 32,000 to say that Apple stock would rise in January; and the other 32,000 to say that it would fall. On 1st February he abandoned the 32,000 people he’d emailed in January with the incorrect prediction. Left with 32,000 people to whom he’d correctly predicted Apple stock’s rise, he emailed 16,000 of these to say that Apple stock would rise in February, and 16,000 to say that it would fall. This pattern continued. By March 1st just 16,000 people remained who’d been given the correct “prediction” each month. It was 8,000 by April 1st; 4,000 by May 1st; 2,000 by June 1st; 1,000 by July 1st; 500 by August 1st; and 250 by September 1st.

In this example, you and 224 other people represent the population of correct predictions. You consider this adviser to be a genius! You have no knowledge of the 63,776 inaccurate predictions.

This example, which is a poor shadow of a similar scenario painted by Nassim Taleb in his book, Fooled By Randomness, shows how blind we are to the part played by luck or chance in the success of people. When a large number of people do something that has very low odds of succeeding, a small number are statistically guaranteed to succeed.

Playing The Odds

Another way to look at this is to ask: would you bet your house on ten tosses of a coin? The rules are: if the coin comes up heads on all ten tosses, you win €100 million. However, if any of the tosses come up tails, you lose the house and get nothing.

This would be a dumb bet to take. Roughly, the odds are that if 10,000 people take this bet, 9,999 will lose their house and one person will win the €100 million.

It’s an extreme example, but it may be analogous to the person who took crazy risks on property investment or on share trading and came out a multi-millionaire. We don’t see the thousands who tried the same thing and failed. And we certainly do not consider that statistically someone was likely to be a winner with this crazy approach. Instead we heap praise on the “winner” and we project all sorts of qualities on them – wisdom, insight, foresight, genius. If you were an entrepreneur and one of these “winners” visited you with a view to deciding whether or not to invest in your business, you’d probably think yourself to be in the presence of brilliance.

Note: This is not to say that these people are not hard workers or that they don’t have talent; just that these qualities are often not much greater in the “successful” people than in the “failures”; luck is frequently a major, if not the dominant, deciding factor.

Side note: Might this be the same for actors, CEOs or any number of success stories?

Risky Business

Risk, alluded to above, is an area of finance that is rarely appreciated by people who are not financial wonks. Consider a situation where Tarquin makes €100m a year for his bank, whereas Sally makes €25m for hers. Generally, in our society, Tarquin will be deemed to be a much better trader than Sally. He’ll certainly get higher bonuses than her. But what if Tarquin’s approach could lose €1 billion for the bank if the market moves against him, whereas Sally’s approach would mean zero return if the market moves against her, but no loss of capital?

These are not the sorts of things we consider as a society when heaping praise on so-called winners.

Unfair Advantage

Obviously there are investors who routinely do well, and what they usually have in their favour compared to others is one or more of the following:

- Better “knowledge”. They might be one of a few people privileged to know that certain land is likely to be rezoned, say, or maybe they have contacts who give them the inside-track on promising startups, something regular mortals never hear about.

- Undue influence. They might have the power to influence the council to rezone land; or power to influence regulations that will benefit companies they have invested in.

- More money or resources. Consider a scenario where the economy suffers a shock and property owners who took out debt obliging them to make regular payments to the bank find themselves unable able to make the payments. Here, they may be forced to sell their property in a fire-sale. Property owners with more resources will be able hold on to their property. Not only that – they could buy the properties being sold in the fire-sale at a bargain price and prosper greatly when property prices rise again.

In all these cases, the “canny” investor is in a privileged position. Their greatest insight may be to recognize that they are no better at predicting the future or at picking successful companies than anyone else, so they focus on developing unfair advantages.

It helps not to be morally squeamish about this. Which may be the most important trait of the canny investor.

A Rare Sage

Of course there are a very small number of investors who seem to have an abundance of wisdom and to keep their moral compass pointing in the right direction. Warren Buffett is one that comes to mind. He takes a long-term view and rigorously and unemotionally analyses the very few stocks he invests in. He seems to be the exception that proves the rule… Investors know nothing.

I’m A Fool

Let me be clear: I’m not claiming any great wisdom on my part.

And I’m not claiming that investors are any less intelligent than the general population.

All I’m trying to do is to burst the fictitious bubble that has many of us believing that people who have amassed a lot of money are particularly smart, or that people who manage money are particularly clever. This is particularly important for money-dependent entrepreneurs to remember and I’ll talk more about this in a future blog.

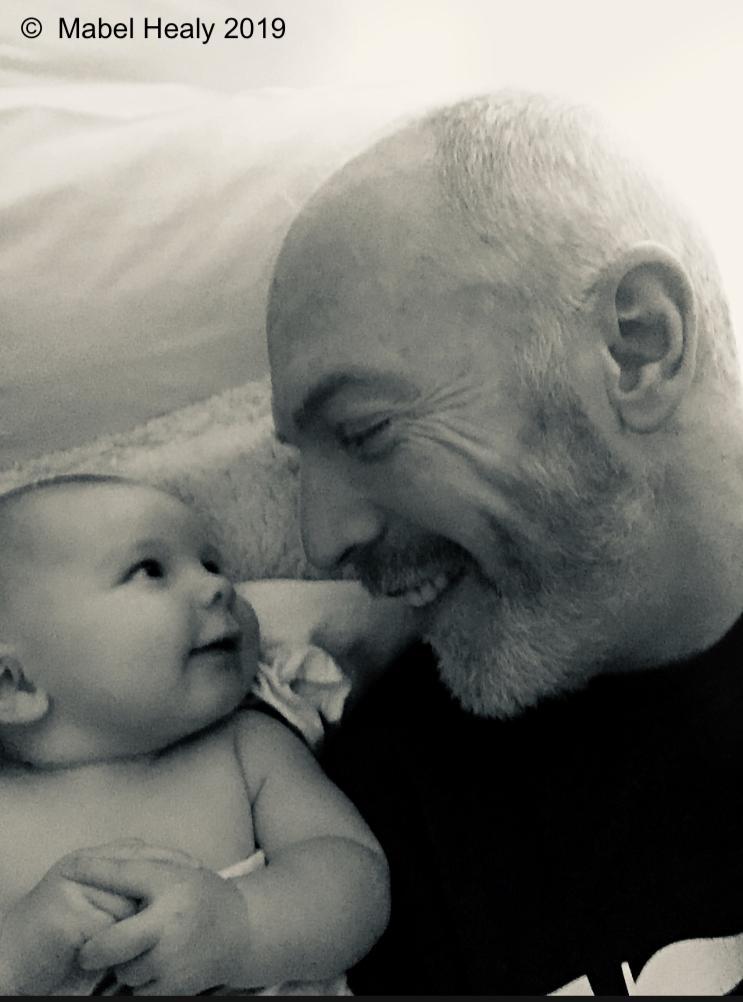

I’ve even seen the you’ve-made-money-so-you-must-be-smart phenomenon in relation to myself. People seem more inclined to listen to me because I’ve had financial success with Exergyn, the company I co-founded, which has now raised over €50 million.

There was a ton of hard work involved, but also a lot of luck. And if the company had failed due to some chance event entirely out of my control – another company, say, coming up with an invention that entirely negated Exergyn’s technology – then I doubt if many would put a lot of store in what I have to say.

Alas, like so many investors, I too know nothing.

Knowing this may be the first step to wisdom.

_________________________

Footnotes

[1] He also wrote the book

[2] There’s a sleight of hand happening here. The 30 largest companies made up 40% of the capitalization weight. 970 smaller companies made up 60% of the weight. Bigger companies generate a smaller return but are less risky. Smaller companies generate a higher return and are more risky. The random portfolios were therefore composed of much more small, high risk high-return companies than the weighted index.

© Alan Healy